Difference between revisions of "2327: Oily House Index"

(→Chart) |

(→Explanation) |

||

| Line 25: | Line 25: | ||

:In the wake of the {{w|Iranian Revolution}}, global oil supply reduced by only 4%, but caused widespread panic and a huge increase in oil price. | :In the wake of the {{w|Iranian Revolution}}, global oil supply reduced by only 4%, but caused widespread panic and a huge increase in oil price. | ||

;The {{w|Gulf War}} (August 1990 - Feb 1991) | ;The {{w|Gulf War}} (August 1990 - Feb 1991) | ||

| − | + | :The Gulf War (August 1990 - Feb 1991) was the invasion of Iraq by the US, which decreased oil supplies and caused a spike in prices. | |

;1999 oil glut | ;1999 oil glut | ||

:In early 1999, Iraq increased its oil production, while the Asian Financial Crisis reduced demand. Prices briefly fell to as low as $16.[https://oilprice.com/Energy/Oil-Prices/A-Recent-History-Of-Oil-Prices-History-About-To-Repeat-Itself.html] | :In early 1999, Iraq increased its oil production, while the Asian Financial Crisis reduced demand. Prices briefly fell to as low as $16.[https://oilprice.com/Energy/Oil-Prices/A-Recent-History-Of-Oil-Prices-History-About-To-Repeat-Itself.html] | ||

Revision as of 00:52, 2 July 2020

| Oily House Index |

Title text: We're underwater on our mortgage thanks to the low price of water. |

Explanation

| This is one of 71 incomplete explanations: Created by an OIL-FILLED HOUSE. Please mention here why this explanation isn't complete. Do NOT delete this tag too soon. If you can fix this issue, edit the page! |

In economics, an index is a statistical measure of change in a representative group of individual data points. Common indices include NASDAQ (a measure of a range of stock prices) and a consumer price index (a measure of retail prices)

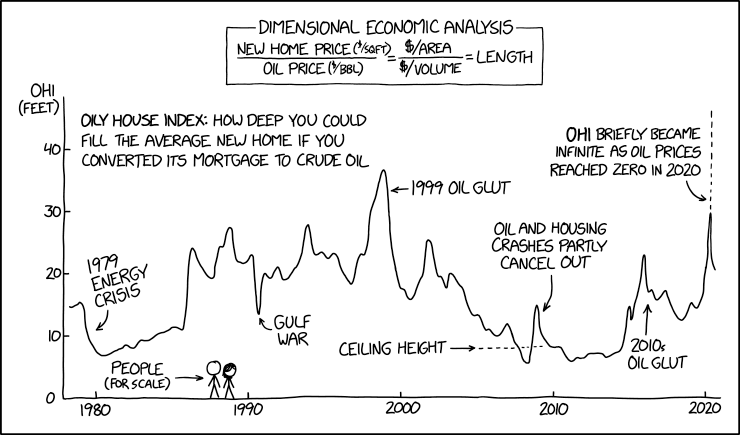

This chart demonstrates an invented index, the "oily house index", which measures a ratio of oil price to average house prices, over time.

The numerator is the average price of a new home (presumably in the US), in USD per square foot ($/sqft). It does not specify what kind of home, or where. One available metric is the average price per square foot of floor space in new single-family houses in the United States which was $118.91 in 2019. The caption refers to converting the mortage of the new house (that is, how much the purchaser borrowed, which could be zero), while the definition simply refers to the new home price (the total value). It is not clear which of these two is used in the chart.

The denominator is the price of oil in USD per barrel ($/BBL). This is also not well defined, although the chart's caption suggests that it is based on crude oil. There are many different indices for different blends of oil in different locations, such as West Texs Intermediate, which is a crude oil commonly used as a global oil benchmark. (Others include Brent and Dubai Crude). The WTI price fluctuated around $55-60 throughout 2019. A barrel is a standard unit of oil volume, roughly 5.615 cubic feet or 0.16 cubic metres.

The index is high when house prices are high and oil prices are low (such as during the 1999 oil glut), and low when house prices are low and oil prices are high (such as during the 1979 energy crisis).

Chart

- 1979 energy crisis

- In the wake of the Iranian Revolution, global oil supply reduced by only 4%, but caused widespread panic and a huge increase in oil price.

- The Gulf War (August 1990 - Feb 1991)

- The Gulf War (August 1990 - Feb 1991) was the invasion of Iraq by the US, which decreased oil supplies and caused a spike in prices.

- 1999 oil glut

- In early 1999, Iraq increased its oil production, while the Asian Financial Crisis reduced demand. Prices briefly fell to as low as $16.[1]

- Ceiling height

- Reinforcing the connection with the metaphorical house filled with oil, "ceiling height" here is shown at somewhere just below 10 feet. The standard ceiling height in US homes is 9 feet for ground floor, and 8 feet on higher floors. [2]

- Oil and housing crashes partly cancel out

- As a result of the financial crisis of 2007-2008, oil prices crashed from $147/BBL in July 2008 to $30 in December 2008. Meanwhile, falling house prices, which had partially triggered the financial crisis, continued to slump across the US, with the Case-Shiller home price index reporting its largest ever price drop in December 2008. Since both oil price and house prices were falling, the effect of dividing one by the other means that the index didn't change significantly, remaining around 8-15 feet.

- 2010s oil glut

- In 2014-16 there was a serious surplus of crude oil, partially caused by increasing shale oil from the US and Canada, a slowdown in demand from China, and increasing fuel efficiency and use of renewable energy. Prices dropped from $125/BBL from 2012 to below $30 in January 2016. By October 2018, prices had recovered to $85/BBL. ]

- OHI briefly became infinite as oil prices reached zero in 2020

- In April 2020, the coronavirus pandemic dramatically reduced vehicle and air transport, crashing oil demand. Oil prices actually went to zero, and even below, several times: oil producers paying consumers to take their oil, to avoid the costs of storing it.[3] Dividing anything by zero yields infinity, hence the "infinite oily house index". The graph should actually wrap around to the negative axis at this point.

The comic then applies dimensional analysis to this index: dividing $/sqft by $/bbl yields a result whose dimension is a linear measurement, which can be called length. 1 barrel is 5.6 cubic feet. The average price per square foot of a new single-family dwelling in the USA in 2019 was about 119 $/sqft, while the price of oil in mid 2019 was about $60/BBL or $337/cubic foot. Dividing gives 60/337 feet-1 or about 5.61 feet. (This doesn't match the value shown on the chart of around 15, so we have done something wrong here. :))

The chart's caption then interprets that length as the depth that a new home could be filled with the crude oil that could be purchased with its price.

Title text

The title text, "We're underwater on our mortgage due to the low price of water" is a pun. A mortgage on a property is considered to be "underwater"[4] when the value of the mortgage exceeds the value of the property. This is bad for both the owner (who owes more money than the property is worth) and the bank (who now have a loan which is not fully secured against a default: if the property owner defaults, the bank will lose money in selling the property).

The title text is hinting at an alternative index based on the ratio of house price to the price of water instead of oil. If the price of water fell, then the index would rise, causing the house to be even deeper in water (following the metaphor of the index as filling the house with physical water). This situation could arise even if the property value remained high, although Randall may be humorously suggesting that the increase in the index would literally flood the property with water, which would then damage it, obviously decreasing its value. (If the index continues to be computed on average house prices, then this single event would not materially impact the index as a whole.)

Transcript

| This is one of 42 incomplete transcripts: Do NOT delete this tag too soon. If you can fix this issue, edit the page! |

Discussion

Dangit Randall, this was my retirement plan & now everybody's gonna want to try it! ProphetZarquon (talk) 00:53, 2 July 2020 (UTC)

Negative Equity (owing more than the house is worth) shouldn't be an immediate problem under most circumstances. If the householder isn't actually wanting to move and can still afford the asked-for repayments then it doesn't change the physical situation at all. The bank has no problems so long as the household has no problems, as they ride over (temporary) pricing crashes and emerge the other side. It's when banks get nervous that the home'owners' might default and thus put pressures on them (e.g. 'negotiating' for unsustainably greater repayments or 'immediate settlement' of the unforeseen temporary deficit) that they could tip their so-called customer over the edge. And an increase of defaulting further suppresses house-prices (general availability of sell-quick homes by owners/bank and/or the reduced neighbourhood value around abandoned properties not sold nor (officially) lived in) to draw more agreements into the self-creating danger-zone. Of course it aint as simple as all that. And permanently being underwater due to coastal flooding, probably won't sit well with the actuaries behind your continuing loan if your property isn't in Innsmouth... 162.158.159.76 09:31, 2 July 2020 (UTC)

- Maths

Can someone figure out where I went wrong here?

>The comic then applies dimensional analysis to this index: dividing $/sqft by $/bbl yields a result whose dimension is a linear measurement, which can be called length. 1 barrel is 5.6 cubic feet. The average price per square foot of a new single-family dwelling in the USA in 2019 was about 119 $/sqft, while the price of oil in mid 2019 was about $60/BBL or $337/cubic foot. Dividing gives 60/337 feet-1 or about 5.61 feet. (This doesn't match the value shown on the chart of around 15, so we have done something wrong here. :))

Thanks. Stevage (talk) 00:54, 2 July 2020 (UTC)

- Since barrels are in the denominator, you have to divide by 5.6 to get the price per cubic foot. LegionMammal978 (talk) 01:00, 2 July 2020 (UTC)

($/area)/($/volume)=($/sq.ft)/($/cu.ft)=1/ft? Shouldn't the result be in ft?

- ($/sq.ft)/($/cu.ft)=($/sq.ft)*(cu.ft/$)=($*ft*ft*ft)/($*ft*ft)=ft I initially made the 1/ft mistake too, until I remembered to invert the fraction in the denominator172.69.63.155 14:53, 8 July 2020 (UTC)

- Units

Shouldn't area divided by volume be height, not length? It would also fit better with the graph. 162.158.123.173 03:41, 2 July 2020 (UTC)

- For dimensional analysis, you don't care about the physical context of the units, just about the dimension they are associated with. Height is horizontal length, so it has the dimension of length. In the context of the comic this length can be interpreted as a height, but in another context, it could be a length in a different orientation. 162.158.88.78 04:16, 2 July 2020 (UTC)

- Category

Should we start a category of dimensional analysis comics: e.g. 687, 1707, 2312 --WhiteDragon (talk) 07:41, 2 July 2020 (UTC)

- Division Error?

You can't divide by zero; which means Randall made an error. Should we update the page to reflect this? 173.245.52.67 10:25, 2 July 2020 (UTC)

- "OHI briefly became infinite as oil prices reached zero in 2020" could be read as approaching both infinity and zero; that fixes the problem 162.158.74.249 11:18, 2 July 2020 (UTC)

- Randall did not divide by zero. If the price went continually to zero the OHI would aproach infinity. Of course at the time the price hit zero (or negative), then the OHI breaks down, which is what infinite means. So he did not make any error. (Wrote this and had an edit conflict with the first reply.) --Kynde (talk) 11:20, 2 July 2020 (UTC)

- You can divide by zero, its just that those lazy mathematicians haven't defined it yet.

- Programmers have defined it but it isn't a number: x/0 = NaN (Not a Number) 108.162.216.134 11:43, 3 July 2020 (UTC)

162.158.123.155 04:04, 3 July 2020 (UTC)

- Actually, most programmers, including IEEE, define x/0 as Infinity if x > 0, -Infinity if x < 0, and NaN if x = 0 (for floating-point numbers; for integers, it's still undefined). 162.158.62.32

- We defined it; y'all just don't like what we came up with. https://en.wikipedia.org/wiki/Wheel_theory TobyBartels (talk) 06:45, 3 July 2020 (UTC)

- You can divide by zero, but it doesn't do the house any good: House divided by zero These Are Not The Comments You Are Looking For (talk) 22:23, 5 July 2020 (UTC)

- Randall writes “became infinite”, not “became infinity”, isn’t that a difference? Dividing by zero doesn’t give something finite, so it is in-finite, but not ∞, right?

The comic should not use the word "mortgage," because the calculations are based on sale price. The size of the mortgage depends on the down payment. Cellocgw (talk) 11:40, 2 July 2020 (UTC)

- My understanding is that if you fully mortgage your house (so that you now have in your hands enough money to buy the house again) and convert the total amount of money that the house is worth into oil, you can then fill your house with X feet of oil. 141.101.98.56 15:11, 2 July 2020 (UTC)

- Find me a mortgage that will give me 100% of the value of my house. Please! 162.158.123.155 04:02, 3 July 2020 (UTC)

- Hint: Start by not writing in the "Reason for mortgage" box anything like "I want to entirely fill my home with viscous and/or flammable liquid". Notwithstanding what I believe the US calls 'zoning laws'... 162.158.159.14 20:38, 3 July 2020 (UTC)

- Find me a mortgage that will give me 100% of the value of my house. Please! 162.158.123.155 04:02, 3 July 2020 (UTC)

It's a pity the graph doesn't go back as far as the 1973 oil crisis. 141.101.98.26 12:02, 3 July 2020 (UTC)

I belatedly wonder if the title is meant to be similar to some other famous Index that I happen to have not heard of. Searching around, Freedom House is an American... thing, which apparently publishes a "Freedom House Index" which is a sort of measurement of how "democratic" a country is from year to year. So something like that... Robert Carnegie [email protected] 162.158.159.14 21:25, 3 July 2020 (UTC)

Shouldn't the OHI be higher because the footprint of a multiple story house is less than its square footage? - 162.158.74.173

I sent this to Matt Levine, and he included it in his Money Stuff newsletter. [5] Benjaminikuta (talk) 07:01, 8 July 2020 (UTC)