Difference between revisions of "947: Investing"

(→Transcript) |

|||

| (44 intermediate revisions by 28 users not shown) | |||

| Line 8: | Line 8: | ||

==Explanation== | ==Explanation== | ||

| − | {{w|Compound interest}} is a type of {{w|interest}} in which the interest earned is added to the total amount, so that the interest itself then begins to gain interest. This contrasts to {{w|simple interest}}, where the amount used to calculate the interest will always stay at a fixed value. In economics classes, many teachers like to demonstrate extreme examples of compound interest, typically turning a thousand dollars into tens of thousands | + | {{w|Compound interest}} is a type of {{w|interest}} in which the interest earned is added to the total amount, so that the interest itself then begins to gain interest in an exponential fashion. This contrasts to {{w|simple interest}}, where the amount used to calculate the interest will always stay at a fixed value. In economics classes, many teachers like to demonstrate extreme examples of compound interest, typically turning a thousand dollars into tens of thousands thanks to unrealistically high interest rates over several decades. But here, Ponytail discovers that a more realistic example is less than overwhelming. Instead of simple interest of 2% earning $200 in ten years, with compounding $219 is produced, hardly any better on a $1000 investment. |

| − | There is an urban legend that Einstein said that compounding interest is the most powerful force. | + | There is an urban legend that Einstein said that compounding interest is the most powerful force. {{w|Snopes}} has its [http://www.snopes.com/quotes/einstein/interest.asp doubts about it]. |

| + | |||

| + | The idea in the title text that people take advice from physicists making small talk is also referenced in [[799: Stephen Hawking]] and [[1206: Einstein]]. | ||

==Transcript== | ==Transcript== | ||

:Ponytail: Sure, 2% interest may not ''seem'' like a lot. But it's ''compound''! | :Ponytail: Sure, 2% interest may not ''seem'' like a lot. But it's ''compound''! | ||

| − | :[Ponytail opens a computer and begins calculating.] | + | :[Ponytail turns around and opens a computer on a previously unseen desk and begins calculating.] |

| − | :Ponytail: If you invest $1,000 now, in just ten short years you'll have... ...let's see... | + | :Ponytail: If you invest $1,000 now, in just ten short years you'll have... |

| + | :Ponytail: ...let's see... | ||

:Ponytail: ...$1,219. | :Ponytail: ...$1,219. | ||

| Line 27: | Line 30: | ||

[[Category:Comics featuring Ponytail]] | [[Category:Comics featuring Ponytail]] | ||

[[Category:Math]] | [[Category:Math]] | ||

| + | [[Category:Money]] | ||

Latest revision as of 15:44, 4 November 2023

Explanation[edit]

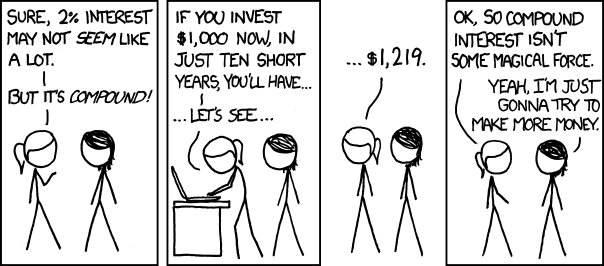

Compound interest is a type of interest in which the interest earned is added to the total amount, so that the interest itself then begins to gain interest in an exponential fashion. This contrasts to simple interest, where the amount used to calculate the interest will always stay at a fixed value. In economics classes, many teachers like to demonstrate extreme examples of compound interest, typically turning a thousand dollars into tens of thousands thanks to unrealistically high interest rates over several decades. But here, Ponytail discovers that a more realistic example is less than overwhelming. Instead of simple interest of 2% earning $200 in ten years, with compounding $219 is produced, hardly any better on a $1000 investment.

There is an urban legend that Einstein said that compounding interest is the most powerful force. Snopes has its doubts about it.

The idea in the title text that people take advice from physicists making small talk is also referenced in 799: Stephen Hawking and 1206: Einstein.

Transcript[edit]

- Ponytail: Sure, 2% interest may not seem like a lot. But it's compound!

- [Ponytail turns around and opens a computer on a previously unseen desk and begins calculating.]

- Ponytail: If you invest $1,000 now, in just ten short years you'll have...

- Ponytail: ...let's see...

- Ponytail: ...$1,219.

- Ponytail: Ok, so compound interest isn't some magical force.

- Megan: Yeah, I'm just gonna try to make more money.

Discussion

Accounting for inflation, you'll probably end up losing money if you're just relying on bank interest for income. Davidy22 (talk) 10:04, 9 October 2012 (UTC)

- Losing money compared to what? Even if inflation is 3%, getting 2% interest in a bank is better than getting 0% interest under your mattress... 72.169.224.98 14:09, 6 December 2012 (UTC)

- Actually, putting money in the bank, you lose more in inflation than you gain in interest. It's really a scam. However, by putting it under your mattress, you're taking it out of circulation and, in effect, increasing its value through deflation. It really IS a better alternative. At least until you put it back into circulation, then the deflation is undone but, by then, it's no longer in your hands so what the hell do you care?76.29.225.28 06:01, 8 July 2013 (UTC)

- Unless you own a bank, it's unlikely that the quantity of money you're able to store in your mattress will have any effect on the rate of inflation. 173.245.56.61 20:38, 19 November 2013 (UTC)

- An alternative to investing in a bank account is to do with your money what the bank intends to do with your money, which is to loan it to other people at a higher interest rate, higher than the rate of inflation. Of course, some fraction of these loans will never be repaid, and you can't simply withdraw your money whenever you feel like it, so this type of scheme works better if you have tons of money to begin with-- more than just a thousand dollars seed money.63.155.139.54 14:39, 26 April 2013 (UTC)

- You don't really have to have the money. You just have to be buddy-buddy with the Fed. Banks are allowed to lend out ten times more money than they actually have.76.29.225.28 06:01, 8 July 2013 (UTC)

- I see! So in order to avoid having to use a bank, you should... become a bank! ...oh.--199.244.214.110 20:42, 2 May 2013 (UTC)

- Banks don't have the luxury of being able to put all their money in insured term deposits. Promethean (talk) 03:08, 3 May 2013 (UTC)

Compound interest is actually extremely powerful, if you have enough interest and enough time. 10% interest (like what you'd get from a good mutual fund) over 30 years (a little under the length of an average working career) gives a pretty impressive return. 108.162.219.47 (talk) (please sign your comments with ~~~~)

- Exactly. The only reason the return here is unimpressive is the ridiculously low interest rate that won't even outpace inflation. With a good rate of return (10-15%), compound interest can work for you. I don't like Randall's implication that compound interest is over-hyped; it's not magical, but it is extremely powerful. NealCruco (talk) 16:14, 29 April 2014 (UTC)

Banks are not typically places one would look for investment purposes. Sure, it's fine to squirrel some money away in a savings account or other high(er)-liquidity vehicle. The point here is that if you are going to invest in any meaningful way, then you have to resign yourself to the fact that your money will become more illiquid, and therefore less accessible. So, investing in a mutual fund or workplace-friendly 401(k) is actually a really great way to tap into the "power" of compound interest. Start off investing in high-risk index funds (usually tracking the S&P 500 or other small-to-medium sized business aggregator). You should be making something like 10-15% y-o-y at least. Then move into bonds and treasury bills (lower return but safer) as you get closer to retirement. Orazor (talk) 13:43, 30 July 2014 (UTC)

I don't know if Einstein did or did not say that statement; but I always found it more profound than a mere personal finance exhortation. Compound Interest is a long-term exponential growth force. To my knowledge, there are no such forces in physical systems (there are long-term exponential decay forces, such as nuclear decay and absorption by extended partially transparent media; and short-term exponential growth phenomena -- rapidly limited by fuel -- such as supernovae, but no sustained exponential growth phenomena I can think of). Biological systems, in contrast, are largely defined by the interactions of competing exponential growth forces. Economic forces, created by living organisms, but limited by the capacity of said organisms to transform their physical surroundings, give the appearance of a long-term exponential growth force (which is really a physics impossibility). Hence, if it is really as described (and there are no hidden risk factors or sustainability limits), then compound interest, really, is the most powerful force in the universe. Mountain Hikes (talk) 11:50, 19 January 2016 (UTC)